Power of Compounding in Mutual Fund.

Which life normally we preferred, plain, blank, boring, prototype or with lot of toppings and exciting? Certainly, with full of exciting life. The amount of returns on our investments also must be full of excitement and CAGR is that only.

The rate of return on investment is referred to as compounding interest. Compound interest causes your investments to grow considerably over time. As a result, even a relatively small initial cost amount can result in greater wealth generation if you choose a long-term investment outlook, say 10 years.

What Is Power of Compounding?

The Power of Compounding refers to the interest you earn on your previous interest. When you earn interest on your principal amount, it is added to the original amount, which becomes the principal for the following cycle.

This allows your interest to rise significantly. Compounding interest can be positive or negative depending on the market. Compounding works by dramatically growing someone’s assets. It keeps adding the profit it manages to earn back to the principal amount and then reinvests the total amount to speed up the earnings profit process.

Assume you put Rs. 1,000 in a fund that pays 10% interest per year. Your investment grows to Rs. 1100 after the first year, Rs. 1210 after the second year, and continues.

How does the power of compounding in Mutual Fund?

Compounding power in mutual fund investments could be one of the most impactful methods of creating wealth. Assume you decided to invest Rs 1000 and earned Rs 50 in compound growth on this investment.

The profit will now be calculated on Rs 1050 rather than Rs 1000 in the next compounding cycle. As a result, compounding has the potential to grow the corpus tremendously rather than gradually.

Let’s understand more by an example of a Systematic Investment Plan (SIP)

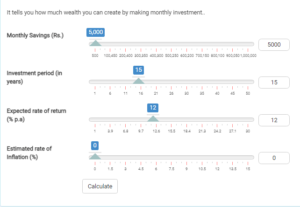

This calculator will help you to Visualize the amount accumulated with a regular investment with an annual increase of your sip amount

If you invest Rs. 5,000/- per month for a period of 15 years, expected rate of interest 12% you can create your wealth equivalent to Rs. 25,22,880/-

Note: Based on monthly compounding*

SIP investments in mutual fund schemes allow you to reap the advantages of compounding. As we have seen in previous examples, the compounding effect of long-term investment can grow. As a result, SIP as well as the power of compound growth go seamlessly together.

SIP refers to the capacity to invest in small, pre-determined amounts of funds in your picked mutual funds, thereby saving you from having to time the stock market and instilling an organized investing method into your schedule. The number of units of mutual fund investments purchased each month varies depending on market conditions. The ability to compound adds to this.

Conclusion: – Compounding works in this manner, so take advantage of the power of compounding and begin investing in mutual funds right away.

Contact Us: 9595889988

Email Us: wecare@imperialfin.com

Follow Us: https://www.facebook.com/imperialfin/

Follow US: https://in.linkedin.com/company/imperialmoney

Download App: https://play.google.com/store/apps/details?id=com.iw.imperialmoney

Subscribe to YouTube Channel: https://www.youtube.com/c/IMPERIALMONEY