blog address: https://www.promantra.us/post-22

keywords: Health Care, Medical Billing, Medical Coding,Healthcare IT Industry, Revenue Cycle Management Services

member since: Apr 20, 2021 | Viewed: 558

THE REVENUE CYCLE - CHAIN OF EVENTS

Category: Health

Isn't 120 days too long to get paid for what you billed? If you have a sizable number of claims that are not getting paid or are getting paid after 120 days from the billed date, something is wrong and needs an immediate fix. Here are some of the best practices that will allow you to reduce your days in AR and collect your bills faster from the insurance. This is like a jigsaw puzzle that you cannot complete or falls apart if even one piece of the puzzle is missing. In our opinion, Medical Billing is a chain of events. If one step is done incorrectly, all the subsequent activities go for a toss and you will in-turn end up spending double the time in AR follow-up. Front Office: The role of front office executive is very crucial. They are responsible to get the right information and collection all the documents and information required for billing insurance and also Verify the Coverage. There are a lot of claims that get denied due to incorrect demographic information entered at the front office or wrong / inactive insurance IDs collected. Ensure the patients are made aware of the co-pays or patient responsibilities as per the insurance so that this does not come as a surprise to them. Entering Charges Accurately: This task is to be taken care of by a Charge Entry specialist and not by providers or front office executives. Incorrect charges will not only hold up your payment but also increase your AR days. This is considered one of the pivotal task that needs due attention at all times. All documents necessary for charge entry like medical logs, procedures, lab records, discharge summaries etc should be referred to thoroughly before completing this process. Claims Processing and Submission: Ensure that a quality check is done to ensure claims are clean before submitting them to the insurance through the clearing house. Once submitted, be sure to visit the clearing house site the next day to check for the rejections and immediately address it rather than accumulating it. If the claim successfully goes through the system, make sure to follow-up with the carrier if no payment is realised or no EOB is received within 30 days. If any EOB is received with a denial or underpayment, be sure to address it the same day by appealing. Remember, time is the important factor in getting these tasks. The only way one can make sure these activities are taken care of in a timely manner is to make a standard list of activities to be performed on a daily basis. If you do not have enough time and resources to manage these functions internally, then consider outsourcing to companies like Promantra rather than piling up your claims. Insurance Follow-up: This activity requires dedicated effort and one performing this activity should not be occupied with other activities. This is one such activity that is neglected because there is not enough time. So make sure you have adequate AR Associates to take care of the volume of AR follow-up to be done with the carriers. Insurance websites also can be used to check the claims status instead of calling each payor. For better utilization of time, make an effort to segregate the claims by payor, by age, denial reason, by dollar value and prioritize the claims follow-up and Denial Management. We have seen the below priority work for most of the providers to collect the money faster. Following this method helps in properly organizing and tracking your No-Response, Denied and Underpaid Claims. Priority-1: High Dollar High Age Priority-2: High Dollar Low Age Priority-3: Low Dollar Low Age Priority-4: Low Dollar High Age To sum it up, I would say it again. "Revenue Cycle is a chain of events". Each step has to be perfect to ensure there is no missing link in the jigsaw.

{ More Related Blogs }

Health

Lasik Surgery in Mumbai | Lasi...

Dec 9, 2022

Health

Spice Up Your Life With cenfor...

Mar 8, 2022

Health

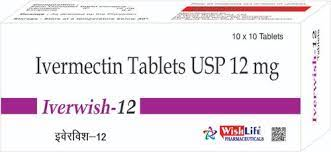

Ivermectin...

Jan 27, 2022

Health

Fertility and Infertility Cent...

Feb 18, 2022

Health

Surrogacy Centre in Jalandhar...

Jan 27, 2016

Health

প্রযুক্তি তথ্যের অনলাইন প্লাটফ...

Mar 21, 2022